Decentralized Finance vs Traditional Finance

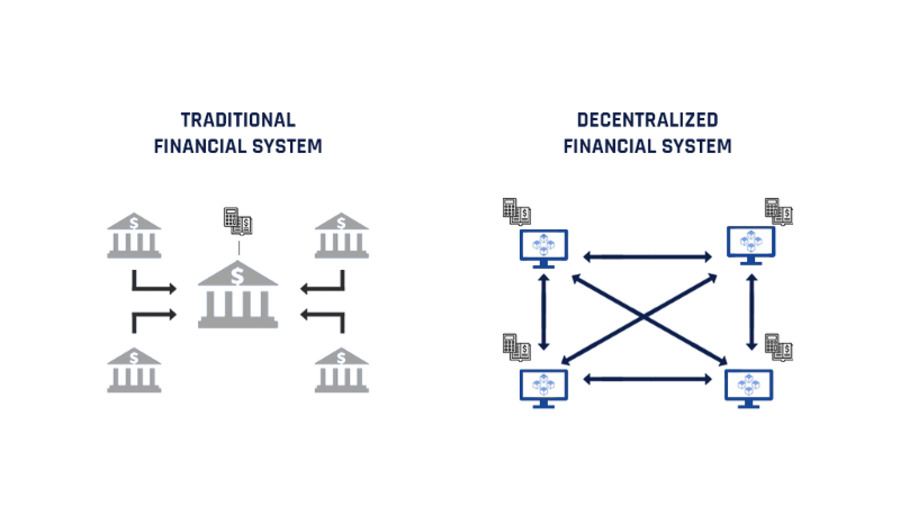

The financial world has experienced tremendous changes over the years, with the advent of technology playing a significant role in shaping the sector. One of the most recent trends in the industry is decentralized finance (DeFi). DeFi refers to a system of financial applications and services that operate on a blockchain, allowing users to conduct transactions without the need for intermediaries such as banks. This article aims to explore the differences between decentralized finance and traditional finance, their advantages and disadvantages, and the potential of DeFi to transform the financial services sector.

Overview of Traditional Finance

Traditional finance refers to the conventional financial system where banks and other financial institutions serve as intermediaries between individuals and businesses. It involves the use of fiat currency, which is issued and controlled central authorities such as governments and central banks. Transactions are processed through intermediaries such as banks, credit card companies, and payment processors, who charge fees for their services.

Overview of Decentralized Finance

DeFi, on the other hand, is a new concept that has emerged in the past few years. It leverages blockchain technology to create financial services and applications that operate without intermediaries. DeFi platforms use smart contracts to automate financial transactions, eliminating the need for intermediaries such as banks. Transactions are processed using cryptocurrencies such as Bitcoin and Ethereum, which operate on decentralized networks.

Advantages of Traditional Finance

Traditional finance has been the go-to option for financial services for many years. The system offers several advantages, including:

Stability and Regulation

The traditional financial system is heavily regulated governments and central banks. This ensures that financial institutions are well-capitalized and can withstand economic shocks such as recessions. The regulation also ensures that financial transactions are secure, and customers’ funds are protected.

Access to Credit

Traditional finance offers access to credit to individuals and businesses. Banks and other financial institutions lend money to borrowers, allowing them to finance projects, buy homes, and grow their businesses. This access to credit has been instrumental in economic growth and development.

Convenience

Traditional finance offers convenient services such as online banking, credit cards, and payment processors. These services make it easy for individuals and businesses to manage their finances and conduct transactions.

Advantages of Decentralized Finance

DeFi is still a relatively new concept, but it offers several advantages over traditional finance. Some of the benefits of DeFi include:

Decentralization

DeFi platforms are decentralized, meaning that they are not controlled a single entity. This makes the system more resilient to attacks and ensures that transactions can be conducted without intermediaries.

Accessibility

DeFi platforms are open to anyone with an internet connection, and users do not need to go through a bank or financial institution to access financial services. This makes the system more accessible to people who are excluded from traditional finance, such as those in developing countries.

Transparency

DeFi transactions are recorded on a public blockchain, meaning that they are transparent and cannot be altered. This enhances trust and reduces the risk of fraud.

Disadvantages of Traditional Finance

Although traditional finance offers several benefits, the system has some drawbacks. Some of the disadvantages of traditional finance include:

High Fees

Banks and other financial institutions charge fees for their services, including account maintenance fees, transaction fees, and overdraft fees. These fees can be high, especially for people with low incomes.

Centralization

The traditional financial system is centralized, meaning that it is controlled a small group of powerful institutions. This can lead to monopolies and limit competition.

Limited Accessibility

Traditional finance is not accessible to everyone, particularly those in developing countries or those with poor credit histories. This can lead to exclusion and financial inequality.

Disadvantages of Decentralized Finance

DeFi also has its own set of challenges and limitations. Some of the disadvantages of DeFi include:

Complexity

DeFi platforms can be complex and difficult to use for people who are not familiar with blockchain technology. This can be a barrier to entry for some users.

Lack of Regulation

DeFi platforms are not regulated in the same way that traditional financial institutions are. This can make it difficult to resolve disputes or protect users’ funds in the event of a hack or security breach.

Volatility

Cryptocurrencies such as Bitcoin and Ethereum can be highly volatile, which can lead to fluctuations in the value of assets held on DeFi platforms.

The Potential of Decentralized Finance

Despite its limitations, DeFi has the potential to transform the financial services sector. Some of the ways in which DeFi can revolutionize finance include:

Lower Costs

DeFi platforms eliminate intermediaries such as banks, which can reduce transaction fees and other costs associated with traditional finance.

Financial Inclusion

DeFi can make financial services more accessible to people who are excluded from traditional finance, such as those in developing countries or those without access to banks.

Innovation

DeFi allows for the creation of new financial products and services that were not possible with traditional finance. This can drive innovation and growth in the sector.

Conclusion

In conclusion, DeFi and traditional finance offer different approaches to financial services, each with its own advantages and disadvantages. While traditional finance offers stability, regulation, and access to credit, DeFi offers decentralization, accessibility, and transparency. The potential of DeFi to transform finance is significant, but the system is still in its early stages and faces several challenges. As the sector evolves, it will be interesting to see how traditional finance and DeFi will coexist and compete in the future.

I’ve been involved with cryptocurrency for three years. I have been a vocal advocate for the people and an active part of the community. I am well-known for my book “Crypto Revolution: An Insider’s Guide to the Future of Money” and blog “The Crypto Chronicles.” In addition, I frequently contribute to CoinDesk, one of the top news websites for cryptocurrencies. I write as well as invest actively in a number of bitcoin initiatives.