DeFi for Investors: Finding the Next Crypto Unicorn

Imagine if you had a superpower that let you invest in the next Google, Amazon, or Apple.

I picture this as a kind of “Spidey Sense” that lets you spot the next high-growth, billion-dollar company. Let’s call this superpower “Uni-Sense.”

Today I’ll help you unlock that superpower.

This is a bold claim, but that’s how confident I am in the growth of DeFi, the Decentralized Finance technology that’s coming to take over the banks. I’m even more confident that they have no idea what’s happening: DeFi is eating banks.

If you’re new to the space, DeFi is a new kind of financial services industry, developed partly in response to the confusing legal status of cryptocurrencies. Because governments can’t make up their minds, there’s this furious push to innovate around them, in ways that can’t be shut down.

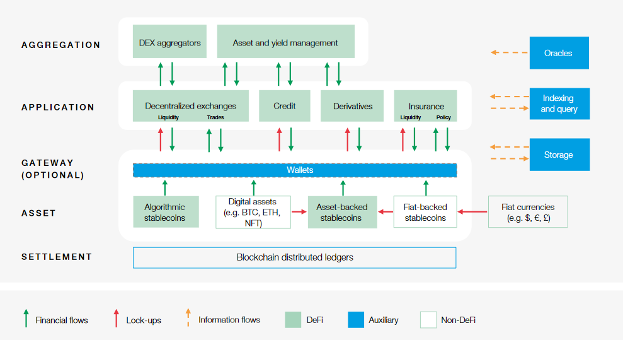

The World Economic Forum has an excellent DeFi Policy-Maker Toolkit, to help educate banks and governments on how it works, and how they might respond. This report is a must-read for blockchain investors, especially this diagram:

This “Defi stack” is a terrific model for making sense of this new financial system. Once you understand these different layers, you can develop your Uni-Sense to help you spot the next unicorn (i.e., the leading company or project) in each layer.

Let’s unpack these layers in more detail. From the bottom up, we have:

The Settlement Layer

This is the infrastructure that DeFi is built upon. For the vast majority of DeFi projects, that layer is Ethereum. As I’ve said again and again, the easiest way to invest in DeFi is to just buy and hold ETH. It’s the foundation of DeFi, and it’s the foundation of a smart DeFi investment portfolio (including mine).

The Asset Layer

These are the stablecoins that serve as “on ramps” and “off ramps” between traditional and digital financial systems. Most of these stablecoins are pegged to the dollar, so there’s no point “investing” in them, as they won’t go up in value—though the companies that issue stablecoins will become extremely valuable as they go public on the traditional stock market. (See my piece on Coinbase stock.)

The Gateway Layer

This is the wallet that holds your crypto. In DeFi, the vast majority of market share is owned Metamask, which is a product Consensys. Currently, Consensys is a private company, but I expect that to change. (Coinbase recently launched its own Metamask competitor wallet — another reason to consider investing in COIN stock.)

The Application Layer

Here’s where things get interesting. These are like the apps that run on your computer or your phone, and the WEF report has split them into four categories (there will surely be more).

1) Decentralized exchanges: These platforms let you exchange (or swap) one cryptocurrency for another. Think of exchanges like Coinbase or Binance, but decentralized. This makes it even easier for investors: instead of waiting for them to go public on the stock market, you simply buy and hold their token, whose price is a reflection of what investors think the future value will be worth. The current DEX leader is Uniswap (UNI), which — true to its name — is already a unicorn.

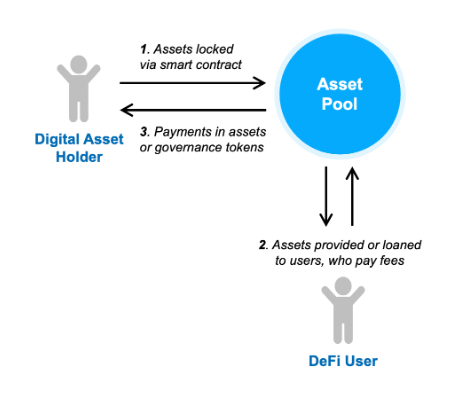

2) Credit: Instead of borrowing from banks, DeFi platforms let users borrow from each other. You earn platform-native tokens for lending and borrowing, and these tokens generally go up as the platform attracts more users (see Step 3 in diagram above).

The current leader in this space is Compound, which is also a unicorn. To be clear, there are two ways to invest in COMP: you can either lend a lot of crypto via Compound to earn COMP tokens (see Step 3 above) — or if you believe in the project’s long-term potential, you can just buy and hold COMP directly.

3) Derivatives: Here things get tricky. A derivative is essentially a blockchain-based token tied to some other asset. There are too many to name: futures, options, prediction markets, and even NFTs are all types of derivatives. The danger with investing in derivatives is that you can quickly build a Jenga tower – i.e., derivatives of derivatives – that can suddenly come crashing down. Tread carefully.

4) Insurance: Trading in DeFi is risky, so one of the biggest opportunities is to simply invest in the companies insuring against all this risk. (Think of Warren Buffett’s huge investment in the insurance company GEICO, one of his most profitable ever.)

DeFi insurance protects users from smart contract bugs or protocol hacks: the current leader here is Nexus Mutual, whose NXM token is not yet unicorn status, making it an interesting investing opportunity. Watch this space with laser eyes.

The Aggregation Layer

Here’s where all these DeFi services can be combined, which is something that’s really unique to this space, and where the banks just can’t compete. Because it’s all based on software, the crypto that you have invested in DeFi can be automatically reallocated, constantly chasing the best return on your money. (Think of it like a robo-advisor on steroids.) In this category are:

1) DEX aggregators: Think of Kayak or Google Flights, which are flight aggregation services that save you time finding the best airfares. If you’re trying to exchange one token for another, DEX aggregators will automatically scan all the top decentralized exchanges, find the best rate, and route your trade there. The leading service is currently 1inch. (Also see our article on Top DEX Aggregators.)

2) Asset and yield management: Traditional asset managers are humans that invest your money in a well-diversified portfolio. In DeFi, this can all be done in code. One example is Balancer (BAL), which is like a self-rebalancing index fund. If you want to keep a portfolio of 70% bitcoin and 30% Ethereum, a Balancer pool will keep them automatically balanced for you, making trades behind the scenes as the price of BTC and ETH changes. Traditional financial managers will be massively disrupted these new asset management websites. Business models are evolving quickly, so train your powers of Uni-Sense on this space.

The Secret Book to Develop Your Uni-Sense

There’s a book with an underground cult following among successful blockchain investors: Technological Revolutions and Financial Capital academic researcher Carlota Perez. (The hardcover sells for $125.00 on Amazon, and it’s worth it.)

Perez argues that technological revolutions come in waves: The Industrial Revolution, the Railway Revolution, the Internet Revolution, and so on. Each of these technological revolutions requires massive amounts of money, because each requires its own infrastructure. Thus, financial and technological revolutions go hand in hand.

To have an Automobile Revolution, for example, you also need to build out roads, access to cheap fuel, auto dealerships, and so much more. Carloads of money pour into these related industries, creating new financial innovations like auto insurance and auto financing. The world begins to change in profound and unpredictable ways: cars mean freedom, so people begin to take more vacations, move to the suburbs, and so on. So these tech and financial revolutions cause permanent, long-term changes in society.

Blockchain geeks love this book because we see this current age as the start of a new technology revolution. Bitcoin, cryptocurrencies, and now DeFi are some of the components of this new wave, which will likely be as disruptive and far-reaching as the Industrial Revolution.

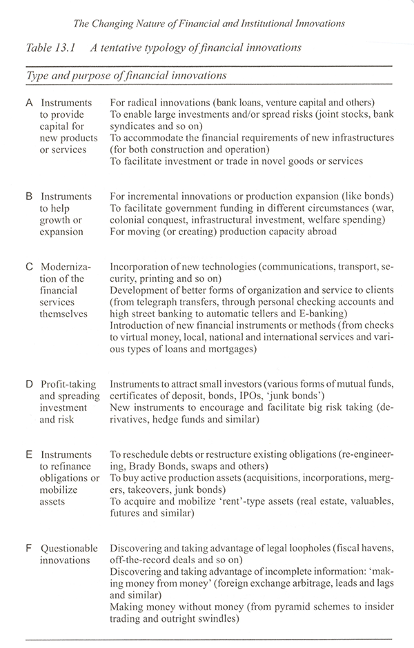

But it was this page that I scanned and pinned to my desktop when I first read the book:

In one page, Perez has neatly summarized the five types of financial innovations that accompany these technological revolutions. I look at this chart regularly to hone my unicorn sensing powers, and I encourage you to spend time absorbing these five categories: they will sharpen your Uni-Sense as well.

The most valuable companies of tomorrow will be the blockchain leaders in each of these categories.

Note that many will not be “companies” in the traditional sense: they will be decentralized projects. Even so, you can invest in them today simply buying and holding the accompanying token.

Putting it All Together

Now, let’s combine Perez’s categories with the DeFi categories from the World Economic Forum report:

| Financial innovation | DeFi category | Current leaders | Investible asset |

|---|---|---|---|

| Providing capital for new products or services | Stablecoins | Tether, USDC (Circle/Coinbase) | Coinbase stock |

| Helping growth or expansion | Credit | Compound | COMP |

| Modernization of the financial services themselves | Distributed ledgers, centralized exchanges, decentralized exchanges, wallets | Ethereum, Binance, Uniswap, Coinbase, ConsenSys | ETH, BNB, UNI, Coinbase stock |

| Profit-taking and spreading investment and risk | Insurance, derivatives | Nexus Mutual | NXM |

| Refinancing obligations or mobilizing assets | DEX aggregators, asset management, yield management | Balancer, 1inch | BAL, 1inch |

This is your framework for the future of finance.

Like the early days of the internet, things are moving fast. These are the current leaders, but new challengers arise each week. Some of these projects may not be around in five years, but the larger trend is here to stay: DeFi is modernizing financial services, and that presents huge opportunities for investors.

TLDR: The simplest way to invest in DeFi is to buy and hold ETH. For those with the time and money, consider diversifying into the stocks and blocks in the table above, as they’re likely to be the unicorns of the future (some are already unicorns today). Do your research. Develop your Uni-Sense. Ride into the sunset.

You may also be interested in reading:

I’m a highly respected and well-known author in the cryptocurrency field. I have been writing about Bitcoin, Ethereum, and other digital assets for over 5 years which has made me one of the most knowledgeable voices in the space. My work has appeared in major publications such as CoinDesk, Forbes, and The Wall Street Journal. In addition to my writing, I’m also an active investor and advisor in the cryptocurrency space.