Bitcoin vs. Stock Market: Bitcoin Up 15x

It’s easy to make money in the block market when the price of bitcoin is soaring. But what about now?

Just three months ago (three months in crypto time = three years in human time), bitcoin was hitting new highs, topping out at about $63,500 per bitcoin. Today, it’s about half that.

Manic, followed by depressive.

If this is your first ride on the crypto roller coaster, you may feel like throwing up. It’s easy to buy bitcoin when times are good, constantly refreshing the price, watching your investment go up and up. Then, in just three months, it loses half its value. Most people decide they’re out, and sell at a huge loss.

We created our Bitcoin Believer Portfolios for exactly this reason.

The basic principles are:

- Invest in a highly diversified portfolio of the total stock market (we recommend Vanguard VTSMX), total bond market (Vanguard VBMFX), and a small slice of bitcoin (between 2-10%).

- Invest the same amount each month, regardless of price (also known as dollar-cost averaging). This protects you against trying to “time the market,” or buying only when prices are high and everyone’s excited.

- Set up a system so you can auto-invest from your bank account on a monthly basis (Coinbase, for example, lets you automatically buy a little bit of bitcoin each month).

- If you want to invest beyond bitcoin, you can also buy Ethereum (plus a few other tokens, if desired), putting no more than 10% of your total investment portfolio in crypto.

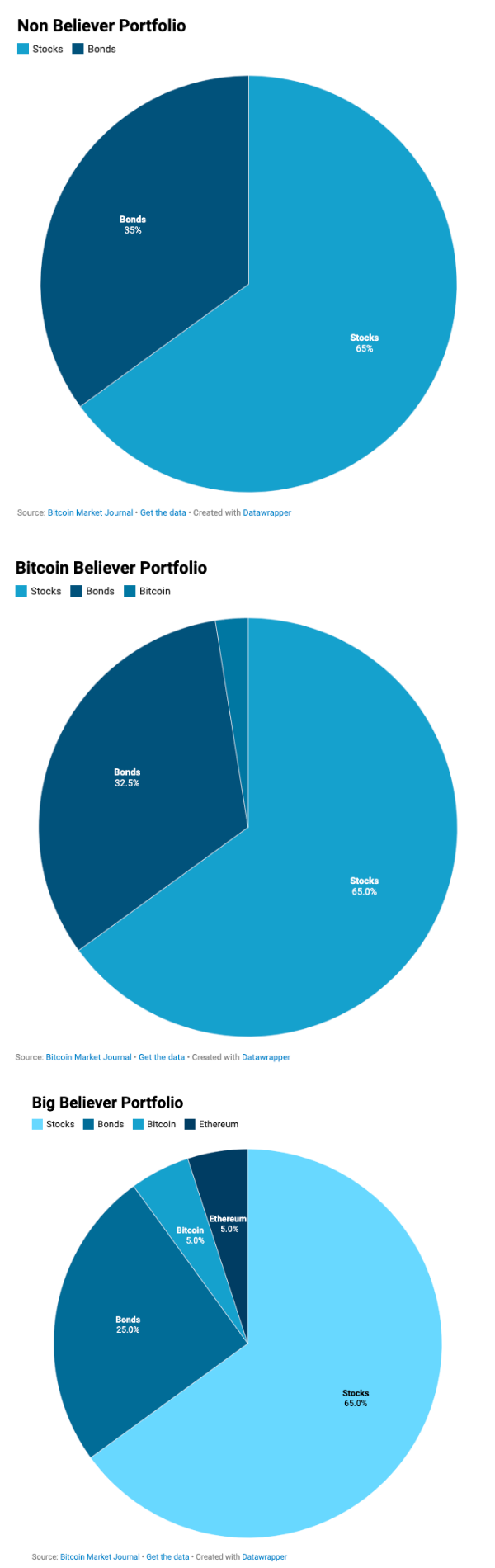

Here is the performance of these three portfolios since we set them up in Sep 2018:

- Non-Believers Portfolio (65% stocks, 35% bonds)

- Baby Believers Portfolio (65% stocks, 32.5% bonds, 2.5% bitcoin)

- Big Believers Portfolio (65% stocks, 25% bonds, 5% bitcoin, 5% Ethereum).

Even in a down market, we are still up. The Big Believers Portfolio has outperformed the plain-vanilla Non-Believers Portfolio by almost 250% … in less than three years!

The power of this approach is that it protects you from yourself. Instead of buying when everyone is rushing into blockchain, then selling at a loss, you can “set it and forget it,” and enjoy the steady growth of your overall portfolio.

By putting only a “slice of the pie” into the block market (i.e., bitcoin and crypto), you protect yourself against catastrophic loss – while still enjoying the upsides of one of the greatest investment opportunities of our time.

It’s a simple approach to keep everything in balance.

The Seven Most Powerful Words for Investors

Years ago, when I was reading the new and expanded version of The Intelligent Investor — Ben Graham’s classic book that taught Warren Buffett how to invest — I was kind of annoyed.

In the revised version of the book, they hired Jason Zweig, a financial columnist from the Wall Street Journal, to add his own thoughts at the end of every chapter. So Ben Graham would dispense these pearls of investing wisdom in his professorial style, then Zweig would come in and add another 5,000 words of his own. It was like listening to a Beatles album, then having a music critic give you his thoughts after every track.

I was like, “Who is this clown?”

But Zweig said two things that stuck with me. The first was that most investors will do better over the long term by just investing in a total stock market fund, instead of trying to pick and choose individual stocks. (More on total stock funds here.)

I’ve come to believe he’s correct: most people don’t have the time or patience for diligently evaluating individual companies, as Ben Graham teaches. That’s what led to our portfolio being based on a total stock market and total bond market fund – instead of trying to find the next AAPL or TSLA, you’re literally investing in the entire market, which has a good record over time.

(Side note: we would do the same for the entire crypto market, but a “total block fund” is not yet easily available to ordinary investors. It’s coming.)

The second thing that Zweig said is to set up an investing system – like our “steady drip” method above – that lets you patiently build wealth over time, without having to worry about the day-to-day price. That way, when someone asks you about the price of bitcoin, you can use what Zweig called the seven most powerful words for investors: “I don’t know and I don’t care.”

“That’s stupid,” I thought when I first read it. “Of course you should stay on top of your investments.” But I’ve come to see the wisdom of this phrase, especially in the block market.

Every day there is a torrent of articles, charts, and tweets about what’s happening in the crypto market. Analysis after analysis, explaining why the price is going up, or down, with all kinds of fancy-looking graphs. I’ll be honest: none of it makes any sense to me. It all feels like cavemen trying to explain the weather.

If you’re really investing on this information, more power to you. I study this stuff for a living, and I still don’t know why bitcoin has lost half its value in three months. But I do believe it will recover, and likely go on to reach new highs. (A $30,000 bitcoin is just a $60,000 bitcoin with a sign reading, “50% OFF.”)

So Jason Zweig’s “seven most powerful words” really are powerful. You can still monitor the price, of course, but with an investing system like our Blockchain Believer Portfolios, you can detach yourself from the manic-depressive mood swings of the market. That’s what he means by “I don’t care.”

I’ll take it one step further: when you have these systems set up, everything can be good news. When bitcoin hits record highs, you can celebrate that you’ve made so much money. When it loses half its value, you can celebrate that now you can buy it on sale. This is a huge mental shift that makes all the difference.

While beginning blockchain investors are obsessively refreshing the price, unable to get anything done because they’re watching and worrying, everything is good news to us. We’re in this for the long term.

Bitcoin is Still Up 15X vs. Stock Market

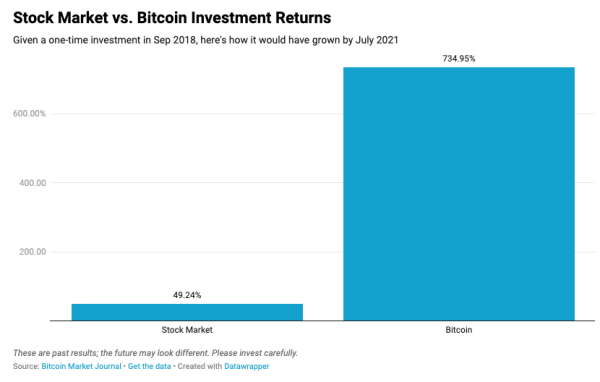

At the top of this column is the chart that should give every financial planner a heart attack.

While the stock market has had a great run in the three years since we launched the Blockchain Believers Portfolio, bitcoin has outperformed the stock market by 15x.

15x the return, in three years.

It’s easy to hear this and say, “Then let’s put it all into bitcoin! Honey, cash out the 401K and sell it to Satoshi!” Again, this is the kind of manic-depressive behavior we want to avoid, because bitcoin could halve its price again in just a few weeks. (That’s the Halvening that matters.)

By diversifying (or balancing) our portfolio, we “smooth out” the crazy price swings of bitcoin — while still participating in its phenomenal growth. Even if bitcoin goes to zero, we’ve only lost (at most) 10% of our overall investments.

It’s tempting, especially if you’re a blockchain believer, to constantly chase the latest and greatest, jumping into DeFi, then NFTs, then the next flavor of the month. Instead, keep it simple. Set up a system, then set it and forget it.

Someday we’ll make this system even easier to set up – just one auto-withdrawal from your account will automatically invest in our Blockchain Believer Portfolios. For now, there’s a little bit of work in setting it up. But you can already see the results, in just three short years.

Imagine what it’s going to look like in thirty.